The Future of Credit Union Risk Management: Predictions and Emerging Trends

- November 18, 2023

- 2 minutes

In the complex landscape of financial services, credit unions must continually navigate the terrain of risk management. The future, however, is not a fixed point on the horizon but a constantly evolving paradigm, shaped by a shifting array of variables, risk factors, and emerging trends. As we gaze into the crystal ball of credit union risk management, we identify several key predictions and trends that are likely to shape this sector in the coming years.

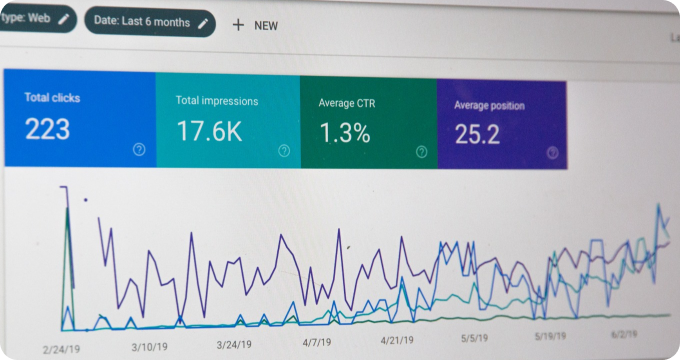

One of the most prominent trends is the digitization of risk management. The advent of advanced analytics, machine learning, and artificial intelligence have enabled a far more scientific approach to risk assessment, prediction, and mitigation. Risk models, for instance, are becoming increasingly sophisticated, capable of not only identifying potential risks but also predicting future threats and vulnerabilities. This level of predictive risk modeling is essentially a form of computational futurology, using vast data sets and intricate algorithms to predict possible future risks based on current trends and historical data.

However, this digitization is not without its trade-offs. While it offers unprecedented predictive capabilities, it also creates new vulnerabilities. Cybersecurity risk, for instance, has emerged as a major concern for credit unions. As our lives become more digitally interconnected, the potential for cyber threats increases exponentially. From data breaches to online fraud, credit unions must be prepared to manage this digital risk frontier.

Another key trend is the increasing regulatory scrutiny of credit unions. Regulatory pressures are mounting, with expectations for rigorous risk management and robust compliance systems. This regulatory focus is not just about ensuring financial stability, but also about protecting consumers and maintaining public confidence in the financial system. The Basel III accords, for example, have introduced stricter capital requirements and more rigorous risk management standards for credit unions. While these regulations are designed to enhance financial stability, they also pose significant operational and financial challenges for credit unions.

The growing emphasis on environmental, social, and governance (ESG) factors is another trend shaping the future of credit union risk management. While traditionally seen as the realm of corporate social responsibility, ESG factors are increasingly recognized as crucial risk indicators. For instance, a credit union's environmental footprint can impact its reputation, regulatory compliance, and financial performance. Similarly, governance practices can affect a credit union's risk profile, from its risk management processes to its board oversight.

Credit unions must also grapple with the risks associated with climate change. From the physical risks of extreme weather events to the transition risks of shifting to a low-carbon economy, climate change poses significant challenges for credit union risk management. Central banks and regulators are already signaling that they expect financial institutions to integrate climate risk into their risk management frameworks and stress testing.

The evolution of credit union risk management is thus a story of constant adaptation, driven by technological innovation, regulatory change, and emerging societal trends. While the future may be uncertain, one thing is clear: risk management will remain a cornerstone of credit union operations. As the complexity of risks grows, so too will the sophistication of our risk management tools and strategies.

In conclusion, the future of credit union risk management will be shaped by a multitude of factors, from digitization and cybersecurity to regulatory pressures and ESG considerations. Navigating these complex dynamics will require not just technical expertise but also strategic foresight, as credit unions seek to anticipate and manage future risks in an increasingly volatile and unpredictable financial landscape.

Learn More

Unleash the power of financial stability and security by diving deeper into our enlightening blog posts on credit union risk management. For an unbiased, comprehensive view, they are encouraged to explore our meticulously curated rankings of Best Credit Union Risk Management.

Popular Posts

-

11 Reasons Why Your Credit Union Needs Robust Risk Management Strategies

11 Reasons Why Your Credit Union Needs Robust Risk Management Strategies

-

The Future of Credit Union Risk Management: Predictions and Emerging Trends

The Future of Credit Union Risk Management: Predictions and Emerging Trends

-

Ask These Questions to a Credit Union Risk Manager to Choose the Right Institution for You

Ask These Questions to a Credit Union Risk Manager to Choose the Right Institution for You

-

4 Essential Questions to Ask Your Credit Union Risk Manager

4 Essential Questions to Ask Your Credit Union Risk Manager

-

7 Things I Wish I'd Known About Credit Union Risk Management Before Hiring a Specialist

7 Things I Wish I'd Known About Credit Union Risk Management Before Hiring a Specialist