7 Things I Wish I'd Known About Credit Union Risk Management Before Hiring a Specialist

- December 02, 2023

- 2 minutes

Risk management, an inescapable facet of any financial sector, plays a particularly significant role within the operations of a credit union. To make the leap from understanding the concept to executing it successfully requires an intricate dance of knowledge, experience, and foresight. Unfortunately, those new to the realm of credit union risk management often have to learn critical lessons the hard way.

Drawing from my personal experience hiring a risk management specialist, I wish to impart seven insights that I wish I’d been privy to beforehand. These insights traverse the spectrum of theoretical constructs, practical applications, technological tools, and industry best-practices. My hope is that these insights will enlighten those considering similar paths and foster more informed decision-making.

-

The Pertinence of Basel Accords:

The Basel Accords, developed by the Basel Committee on Banking Supervision (BCBS), provide a regulatory framework for addressing risks in banking operations. Understanding these Accords is crucial since they dictate minimum capital requirements, which influence credit risk, operational risk, and market risk. A risk management specialist should ideally have an intimate comprehension of these Accords and their ramifications.

-

Risk Assessment and Risk Appetite:

It's important to grasp the distinction between risk assessment and risk appetite. While the former deals with identifying and evaluating possible risks, the latter pertains to the level of risk a credit union is willing to accept. An adept specialist will not only analyze potential risks but will also work to align these risks with the organization's risk appetite.

-

The Efficacy of Stress Testing:

Stress testing is a simulation technique used to assess a financial institution's resilience to adverse market conditions. Despite its robust usefulness, stress testing is often underutilized due to its perceived complexity. However, hiring a specialist with expertise in stress testing can significantly enhance your risk management strategy by enabling a proactive approach to potential crises.

-

The Utilization of Technology:

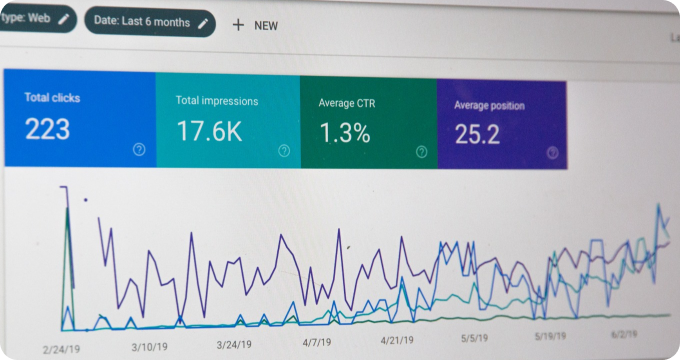

In today's digital age, technology has permeated every sphere of life, including risk management. Advanced software can automate risk identification, evaluation, and monitoring processes, thereby enhancing efficiency and accuracy. However, one must bear in mind that while automation can yield significant benefits, it should not completely replace human judgment and analysis.

-

Legal and Regulatory Compliance:

Possessing a solid grounding in the legal and regulatory landscape is non-negotiable for a risk management specialist. The penalties for non-compliance can be severe and may include fines, sanctions, and reputational damage. Hence, it's crucial to ensure your specialist is well-versed in relevant laws, regulations, and industry standards.

-

The Multi-Dimensional Nature of Risk:

Risks are not isolated phenomena; they are interconnected and can influence each other in complex ways. For instance, credit risk could lead to liquidity risk, which might then precipitate operational risk. A competent specialist should, therefore, possess a holistic understanding of risk, recognizing its multi-dimensional nature and potential chain reactions.

-

The Importance of Continuous Learning:

The financial sector is dynamic, characterized by continual shifts in market conditions, regulations, and technologies. Therefore, risk management is not a one-time task, but an ongoing process that requires constant learning and adaptation. A prospective specialist should embrace this ethos, demonstrating a commitment to continuous learning and innovation.

In conclusion, the successful management of credit union risks hinges on a multifaceted blend of theoretical understanding, practical knowledge, and technological proficiency. Hiring a risk management specialist can, undoubtedly, augment your strategies. However, it’s essential to appreciate the complexities involved and make informed decisions based on the unique needs of your credit union.

Learn More

Unearth the secrets of credit union risk management and fortify your financial future by delving deeper into our enlightening blog posts. They are encouraged to explore our comprehensive rankings of Best Credit Union Risk Management for an objective, insightful perspective.

Popular Posts

-

11 Reasons Why Your Credit Union Needs Robust Risk Management Strategies

11 Reasons Why Your Credit Union Needs Robust Risk Management Strategies

-

The Future of Credit Union Risk Management: Predictions and Emerging Trends

The Future of Credit Union Risk Management: Predictions and Emerging Trends

-

Ask These Questions to a Credit Union Risk Manager to Choose the Right Institution for You

Ask These Questions to a Credit Union Risk Manager to Choose the Right Institution for You

-

4 Essential Questions to Ask Your Credit Union Risk Manager

4 Essential Questions to Ask Your Credit Union Risk Manager

-

7 Things I Wish I'd Known About Credit Union Risk Management Before Hiring a Specialist

7 Things I Wish I'd Known About Credit Union Risk Management Before Hiring a Specialist